Discover the thrills and also tests of futures trading, yet step carefully as threats loom ahead. Below, we’ll acquaint you with the crucial knowledge of futures trading threat management, encouraging you to with confidence spend as well as trade futures with sound judgment.

1. Understanding the Essentials of Futures Trading

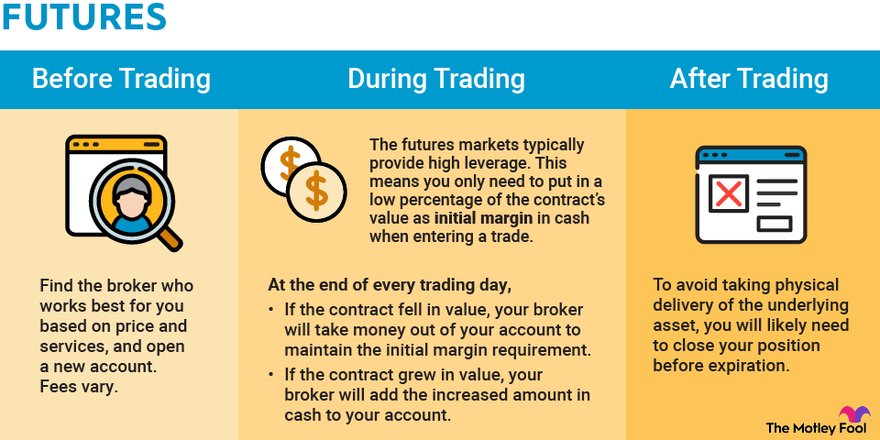

Take part in futures trading 해외선물 to buy commodities, money, and other properties through an agreement that accepts buy or offer them at an established rate and also the date in the future. Experience the different methods of futures trading contrasted to equip trading, as the contract worth emphatically depends upon the hidden possession.

Understanding the ins and outs of the futures trading market is crucial for any capitalist. Familiarizing on your own with various types of futures contracts, tracking the ever-changing market variables impacting costs, and also browsing the integral challenges all call for an eager understanding of the dangers included. Keep informed as well as watch coming up, and also the globe of futures trading can be a lucrative venture.

2. The Dangers of Futures Trading 선물옵션

Possible dangers have to be thoroughly evaluated when considering futures trading. The following are the main dangers to be familiar with:

※ Market Threat:

Market volatility affects the worth of futures rates, as numerous factors like supply and need, geopolitical events, and financial data come into play. Therefore, your futures agreement faces risks of fluctuation that can be monetarily significant.

※ Leverage Risk:

Futures trading is a high-stakes game that invites you to spend by making use of obtained cash. With utilization, you have the potential to see explosive returns- yet there’s a price to pay. The danger of loss is additionally intensified, putting your financial stability on the line.

※ Counterparty Risk:

When taking part in futures trading, the threat of 해외선물대여계좌 counterparty default is a really actual worry. Basically, you’re making a contract with one more celebration, as well as if they fall short to supply on their end of the bargain, it might suggest a substantial loss for you. Thus, it is very important to thoroughly take into consideration the integrity and creditworthiness of any type of prospective trading partner before participating in any kind of contract.

※ Liquidity Risk:

Browsing the unforeseeable waters of futures markets needs quick reflexes and also an eager capability to buy and sell at the ideal minute. Failing to do so could result in the feared situation of being caught in a losing investment without any way out. Remain on top of your game and also maintain your finger on the pulse of the market to prevent costly errors.

3. Handling Danger in Futures Trading

Futures trading is not without its share of dangers. However, it is very important to keep in mind that their work means to reduce those threats. Developing danger administration techniques is essential for any individual curious about taking part in futures trading. Right here are some tips to assist you to reduce prospective losses and optimize returns:

※ Diversification:

Investment diversification is vital to reducing your risk as well as optimizing your potential returns. By spreading your resources across a variety of possession courses, you can reduce the effect of market fluctuations as well as shield your finances. Do not put all your eggs in one basket – expand wisely for a smoother investment trip.

※ Stop-Loss Orders:

Effectively suppress your potential losses with a stop-loss order – a straightforward yet powerful tool that enables you to sell your futures contract automatically if the marketplace cost dips listed below a predetermined threshold. Stay ahead of the contour and also secure your investments.

※ Hedging:

Hedging entails taking a placement 해외선물커뮤니티 in the futures market that’s contrary to your existing position in the hidden asset. This can aid balance out potential losses.

※ Position Sizing:

Position sizing includes identifying the appropriate size of the placement of your future based on your risk resistance and also financial investment objectives.

Conclusion

If you want to make money through futures trading, it’s vital to comprehend the prospective threats included. Fortunately, efficient risk administration strategies can raise your possibilities of success. By understanding the fundamentals of futures trading, producing a threat monitoring method, and also staying with it, you can alleviate potential losses and appreciate revenues gradually.

It’s essential to bear in mind that trading futures 해외선물분석 come with fundamental dangers that shouldn’t be taken lightly. You ought to be mindful of the amount of money you spend and also just allocate what you can fairly shed. To make educated selections, carry out extensive study and also look for guidance from a financial expert when picking financial investment alternatives.